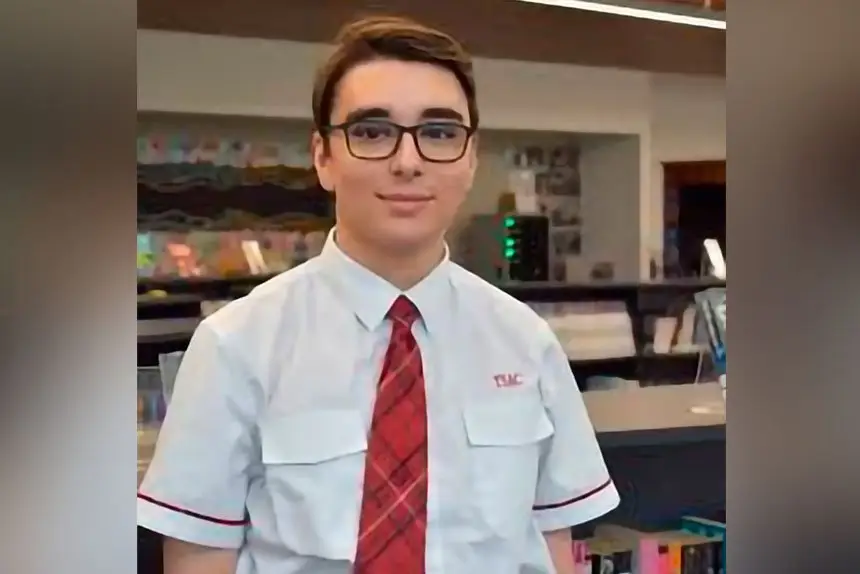

A LITTLE old lady goes to the train station and requests a ticket for her journey, and the young man behind the counter says to her, “OK! One more time: Go home and log on to our website from your computer, create an account and purchase your ticket with your credit or debit card, download the ticket to a smartphone, then come back at the allocated time.”

“Just what part of ‘easier and more convenient’ don’t you get?”

Do you find this familiar?

How many older folk, seniors if you like, have had this issue to deal with. A bit of a minefield if you are not familiar with the process.

However, and this column has touched on this before, it appears that in the next few years there could be even less cash around and for some people this will really hurt.

There are banks now starting to go cashless, making it very difficult for those older folk who are resisting change to work out what to do with their money.

The banks seem to only think of the bottom line, making as much money as they can, sometimes at the expense of their customers.

It’s true that a great deal of people have taken the advice of their banks, and have their smartphones, their debit and credit cards and their “you beaut watch” that not only tells the time, but can download to a printer, see what your pet is up to at home, measure your heart rate and tell you what you want to know in seconds, as well as do your banking.

However, thinking along different lines, think of all the minuses in going cashless:

Think of the children this will affect, grandparents unable to give their offspring money for birthdays or Christmas or any other time for that matter.

Will they have to have a card with a BSB on it?

What about the tradies who make that little extra by fudging the system to make ends meet?

What about the weekend markets where one might spend a few dollars on some item that appeals to you or you want to buy a drink!

Will craft fairs and garden shows now be forced to only accept credit cards and have to charge you what the banks charge for the convenience.

Maybe this will be too hard for some, and gradually all these outings, these cups of tea, meeting people, will go the way of so many things.

Where will this all end?

What about your grandchildren, how will they learn about money, the value of spending only what they have?

For those kids, what will their future be?

Getting back to our little story at the beginning; for those still resisting that change, try and learn the simple ones first, the transfers and the B-pays – they are easiest to control.

There are many safety measures that banks have built in, but be aware – scams are rife in our community these days.

So be careful, have the kids show you how it’s done.