THE beleaguered building industry breathed a sigh of relief at the news last week of an interest rate hold.

Despite an urgent need to address the lack of housing supply in Australia, the number of loans issued for the purchase and construction of a new home has fallen to their lowest level since 2008.

The number of detached building approvals has fallen to its second lowest month since 2013.

HIA’s Chief Economist, Tim Reardon said the lack of new work entering the pipeline threatens to worsen the housing affordability crisis.

“When the RBA first increased the cash rate there was a record volume of houses under construction, and a record volume of new houses approved, but not commenced,” he said.

“This large volume of work in the pipeline has obscured the adverse impact of rising rates on the wider economy.

“Compounding the rise in the cash rate, increased government regulatory costs, rising land prices and construction costs are further impeding an increase in the supply of new homes.”

The RBA has expressed some confidence that inflation will track lower over the next couple of years.

The central bank’s forecast is for CPI inflation to continue to decline, to be around 3.25 per cent by the end of 2024 and to be back within the 2–3 per cent target range in late 2025.

Others were also optimistic that the worst of the rate hikes may be in the rear view. Australian Chamber of Commerce and Industry chief Andrew McKellar said inflation was coming under control.

“The impact of the previous rate increases is clearly starting to come through, with household consumption and dwelling investment weakening,” he said.

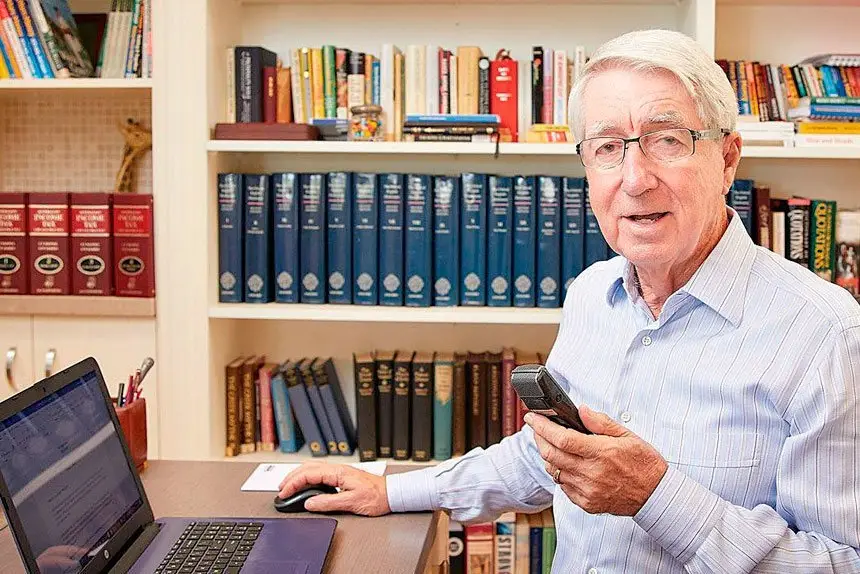

Noel Whittaker from QUT Business School, said the Reserve Bank would have been looking for an excuse to put rates on hold given the amount of anecdotal evidence that the interest rate rises are having some effect on consumer spending.

“However, July has been a big month for price increases, but they are not reflected in last week’s CPI figures but they will be in play at next month’s board meeting, so my view is hold but increase next month.